Buying a Home vs Renting a Home

Buying a home is a big commitment, but it can also offer big rewards. Since you have to pay to live somewhere, why not turn this expense into a savings account through home ownership? And with little or no money down options, you could start today.

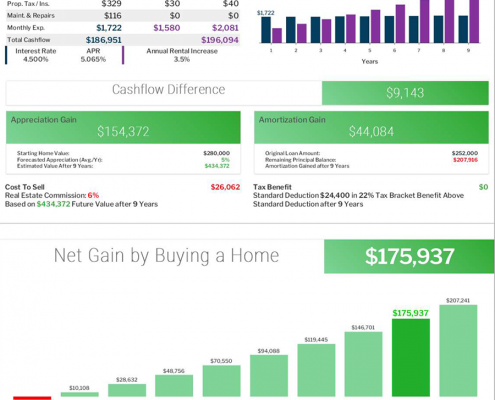

As you can see from the Buy vs Rent scenario above, renting a home produces $0 net gain. On the other hand, buying a home can turn your living expenses into tens or hundreds of thousands in net gain over time. The key is time. It’s best to have a long-term plan (at least 5 years) to stay in the home or rent it once you move out.

If you are considering your first home purchase, click here for a list of the 5 things you need to do to get ready to buy your first home.

Find out how little you need to put down on a home.

USDA, FHA, VA, and State Housing loans are just a few of the little and no-down payment options available to homebuyers. We can help you find the right loan even if you have very little to put down.

How much money do you need to put down when buying a home? A lot of people think you need 10% to 20% of the homes purchase price. That’s a lot of cash. Intercap Lending offers a variety of little to no-down payment options.

I saw this advertising that they could get me in with no money down on a new home! I was like right sure but very skeptical. Never have I had such a great loan officer who bent over backwards and jump through hoops to get me into a condo. And my real estate agent was amazing how we had so much fun looking at condo after condo! It took me 29 years and 4 tries to get where I am at! Thank you Intercap for all your hard work to get me into a new home!!! Gotta say I love you guys!!!!

Reviewed by Anna Adams – See More Reviews